If you haven't come across the term 'pink tax,' chances are you've felt its sting during your everyday shopping trips.

Ever noticed how your floral-scented deodorant costs more than the guy’s version? Ring any bells?

According to a study shared by the World Economic Forum, women end up spending thousands more over their lifetimes on the same kinds of products men buy.

This so-called 'pink tax' highlights how products targeted at women often come with a higher price tag than their male counterparts.

One of the most glaring pink tax examples is the pink tax on period products.

What is the Pink Tax?

The Pink Tax isn’t an official term, but it’s a way to describe a clear pattern of gender pricing discrimination in everyday products.

This gap happens because of how items are marketed and perceived—products aimed at women often cost more, even if they have similar or fewer features than those for men.

Pink Tax and Feminine Hygiene

Period products such as tampons, pads, menstrual cups, are essential for those who menstruate, and yet they frequently fall victim to the pink tax.

This highlights how the perceived femininity of products can impact their economic accessibility, especially when it comes to thecost of menstrual products.

Gender-Based Pricing

Research shows that feminine hygiene products are often more expensive than comparable products marketed to men.

For example, a pack of women's razors might cost significantly more than a similar pack marketed to men, even though they essentially perform the same function.

The same is true for menstrual products. Despite their necessity, menstrual pads and tampons cost more simply because they are marketed to women. This extra cost highlights the economic burden placed on those who menstruate, simply for needing basic hygiene items.

Perception and Marketing

Companies often market period products with additional features such as “comfort” and “discreetness,” which can lead to higher prices.

These products are sometimes packaged with bright colours, floral scents, or other "feminine" touches that contribute to their higher cost. The added features are often not essential, yet they justify a higher price point.

This feminine products pink tax, popularly seen in the example of the tampon tax, in which luxury tax norms are applied to menstrual products show the extent of the pink tax impact on women.

Essentially, feminine hygiene tax describes pink tax on essential items, as if they were inessential.

Economic Impact

The lack of fair pricing for women and the added cost of period products can be a significant financial burden.

Over time, these small but consistent price differences can add up to thousands of dollars, creating a financial disparity, showing the relationship between pink tax and economic inequality.

Issues of period poverty and pink tax are also closely related as the inaccessibility due to period product pricing is made far worse by taxes.

Period poverty occurs when individuals who menstruate lack access to affordable menstrual products, hygiene facilities, and education, impacting their health, education, and economic well-being.

Learn more about this issue by reading our blog on period poverty.

The pink tax worsens this issue by imposing higher prices on menstrual products compared to similar items marketed to men, a clear example of gender-based pricing discrimination.

This combination means that those already struggling financially face even greater challenges in obtaining essential period supplies.

In this case, reusable period products become very important because at a one-time cost, you can use the same product over a longer period of time.

Read more about how reusable period products save you money in our blog.

All in all, addressing both period poverty and the pink tax is important for making sure that everyone has the necessary resources to manage their menstrual health without undue financial burden.

Learn more about how to address this by reading our blog on the social enterprise ending period poverty.

Breaking Down the Pink Tax

Pink Tax Awareness

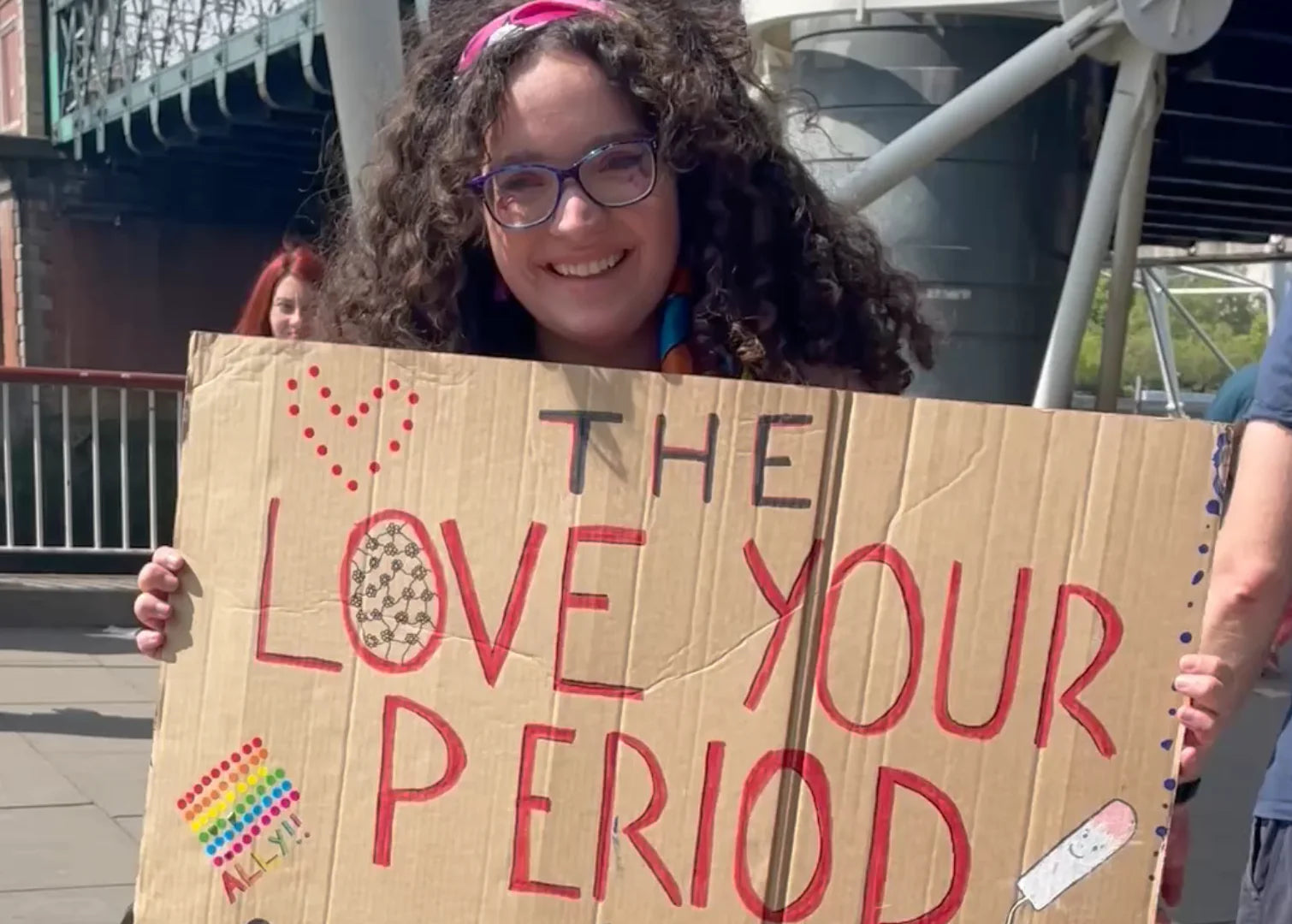

Raising awareness about the pink tax and its impact on period products is crucial.Pink Tax Advocacygroups and activists are working to highlight these issues and push for fair pricing practices.

Some of these groups include Sex Ed Matters UK, and Stop Taxing Periods which was founded by feminist activist and Asan cup user Laura Coryton.

Laura’s tireless efforts to remove the tampon tax in the UK were finally successful in 2021 when the VAT on sanitary products was finally abolished.

As she says, “ the tax was such a clear example of everyday sexism and stigmas which hold gender equality back…”

Despite the small changes, we have a long way to go and one of the first steps for change is to educate consumers about the pink tax. This helps create a more informed public that can demand change.

Pink Tax Legislation

Some regions are taking legislative action to address the pink tax including theelimination of pink tax. Several US states have removed sales tax on menstrual products, recognising that these items are a necessity, not a luxury.

As mentioned before, the UK officially abolished the tampon tax in 2021 but is yet to see that reflected in the price in the actual marketplace.

Similar efforts are being made in other countries, reflecting a growing acknowledgment of the issue.

Alternative Solutions

There are also movements toward providing more affordable and sustainable period products.

Organisations and businesses are developing cost-effective alternatives, such as menstrual cups which can help reduce the long-term cost for women.

Read about how Asan is ending period poverty across villages in Karnataka.

By continuing to advocate for change, support legislative changes, and develop alternative solutions, we can work towards a world where your period does not come with an unfair price tag.

Addressing the pink tax is not just about financial fairness but about ensuring that everyone has access to necessary products without being penalised on a gendered basis.

Want to stay up to date?

Follow us on Instagram

More Posts

View all-

Can you get your period if you’re pregnant?

Many people wonder if you can still get your period while pregnant. The short answer is no, but light bleeding or spotting can happen for other reasons. This blog breaks...

Can you get your period if you’re pregnant?

Many people wonder if you can still get your period while pregnant. The short answer is no, but light bleeding or spotting can happen for other reasons. This blog breaks...

-

Top 5 features for period underwear

This guide breaks down the five most important features to look for including fabric, fit, and safety certifications, so you can find a pair that’s comfortable, leak-proof, and long-lasting.

Top 5 features for period underwear

This guide breaks down the five most important features to look for including fabric, fit, and safety certifications, so you can find a pair that’s comfortable, leak-proof, and long-lasting.

-

-

The hidden environmental cost of disposable period products

Understand the hidden environmental costs of single-use sanitary products.

The hidden environmental cost of disposable period products

Understand the hidden environmental costs of single-use sanitary products.